Northvolt Sustainability and Annual Report 2023

2 July, 2024

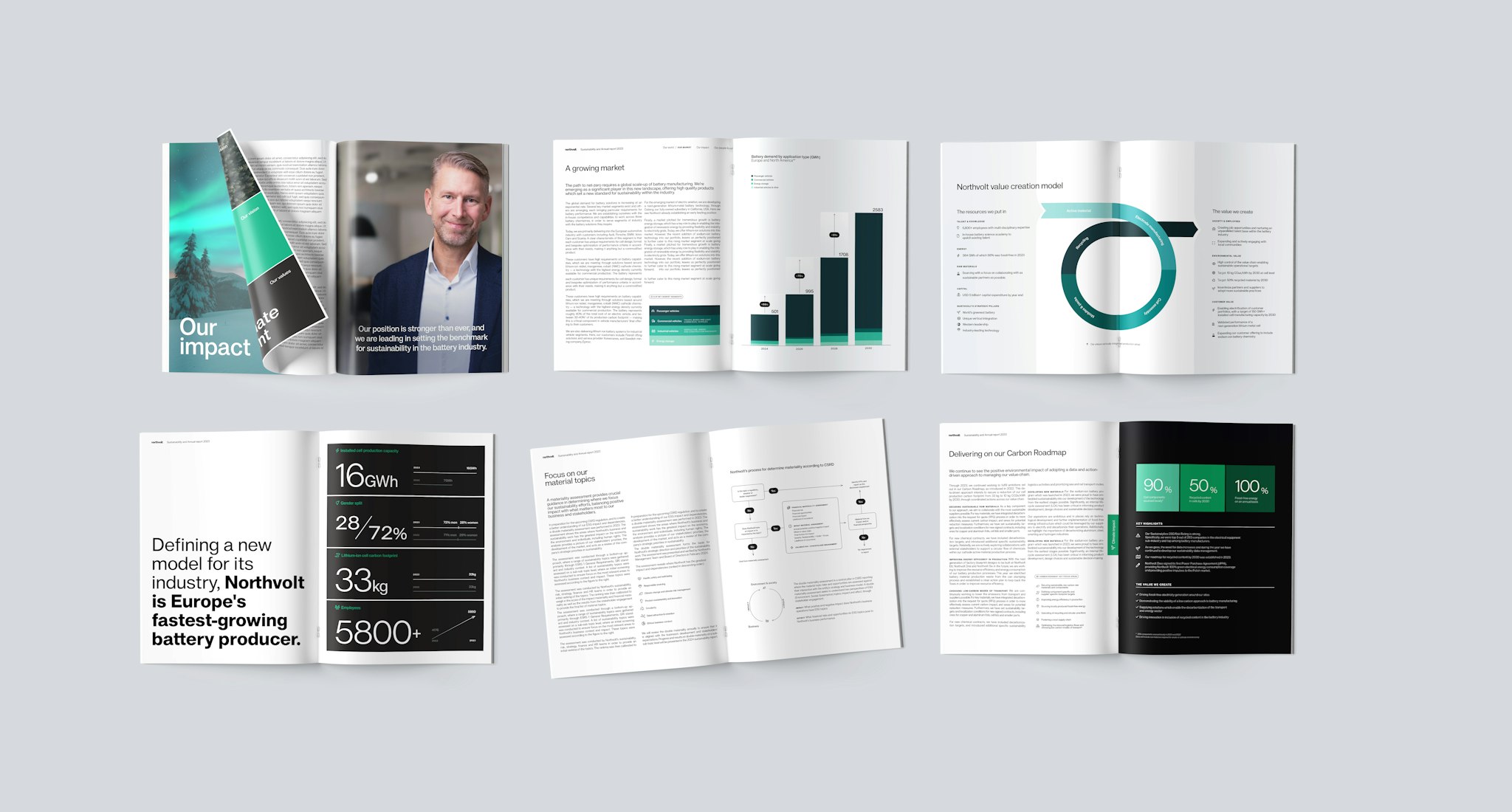

Defining a new model for its industry, Northvolt is Europe's fastest growing battery producer. Our second Sustainability and Annual Report details our approach, progress and impact on the path to building a sustainable battery industry.

Northvolt was established in 2016 with the simple but ambitious goal to build a sustainable battery industry in Europe. Today, we publish our second Sustainability and Annual Report — detailing the presence we’ve established within the industrial landscape and progress we’ve made on our mission.

Investing into the future

Leveraging speed, scale and vertical integration of the value chain in our operations, the company we’re building holds a unique position against the dynamic backdrop of traditional and emerging industry actors.

With a monthly investment rate of $200 million, 2023 was the heaviest investment year in Northvolt’s history. At the same time, we raised an additional $7 billion in financing for our future plans, which include expansion into North America.

Where we’ve focused our capital, the outcomes are evident. The initial phase of our first gigafactory, Northvolt Ett in northern Sweden, is now complete. In addition to employing over 3,500 people, the facility hosts 16 GWh of installed lithium-ion cell production capacity and is delivering cells to customers, including some of Europe’s largest automotive groups.

Significant investment is also being directed towards the expansion of Northvolt Ett, with several new cell manufacturing blocks under development as we work towards a facility operating at 60 GWh of annual cell production capacity.

Through 2023, we also concluded construction and installation work at Revolt Ett — our first full-scale battery recycling plant. Situated alongside Northvolt Ett, Revolt Ett is Europe’s largest battery recycling plant and a plant of unique capability to recycle batteries and manufacturing waste into battery-grade metals for cathode production.

In parallel, we are investing into R&D, customer programs and industrialization platforms to ensure that Northvolt remains at the cutting-edge of battery technology.

A significant example, detailed further in the report, was the launch of sodium-ion battery chemistry — a technology that substantially enhances Northvolt’s offering, by way of enabling low-cost, highly sustainable battery solutions. The sodium-ion program is now being pursued at Northvolt Labs, in Västerås, into which our investment has enabled expansion in capabilities, including via a new R&D facility brought online to strengthen materials engineering and cell design.

Setting the benchmark for sustainability in the battery industry

Alongside investment into Northvolt’s technology and manufacturing platform, we are developing the tools, processes and talent base required to enable the realization of our commitment to sustainability. Here, our ambition is to set the benchmark for sustainability in battery manufacturing.

In the report, we present actions taken throughout the year across our operations, supply chain and governance which have strengthened our position as a sustainability frontrunner.

The path to net-zero requires meaningful activities to reduce Scope 1 and 2 emissions. We continue to improve our performance here, reaching a level of 99% fossil-free energy in 2023.

However, our biggest challenge and remaining opportunity for driving positive change lies in our Scope 3 emissions in our value chain. Here we have made several strides throughout 2023, including through our signing of a new partner for the supply of copper foil to be produced in a new factory in Europe using 100% recycled material and powered by 100% renewable energy. The commissioning of our Revolt recycling plant also brings our closer to our aim of creating a circular setup which reduces the need for virgin material for our products.

Reflecting the increasing maturity of our sustainability efforts, Northvolt received both an industry-leading ESG risk rating by Sustainalytics, as well as the highest possible rating by CICERO/S&P Global on our green finance framework which supported our signing of the largest green loan in Europe to date.

Our outlook on the future is bright. As we move forward with the determination that is required in building this new industry, we do so with the support of a broad investor base and line-up of premium tier automotive customers.

Read the report here.