Blueprint for a Green Recovery

13 May, 2020

As society begins to look beyond the pandemic, we find ourselves at an inflection point. Faced with the need for an economic jump start, a green recovery is unquestionably the right direction to take.

Entering this new decade, civilisation faced the greatest challenge it has yet encountered. In addressing climate change, the need to decarbonize energy systems carries profound consequences for all levels of society, from the individual to corporations and states alike. While technology has a great role to play in the shift to a sustainable world, the importance of responsibility of all stakeholders cannot be ignored.

In the beginning of the year, a new threat emerged with COVID-19. The pandemic which ensued has radically shifted the world into unknown territory – the reality of which is simply unprecedented.

The true costs and economic upset of the pandemic will likely not reveal themselves fully for some time to come. In Europe alone, initial estimates suggest GDP decreased 3.5% in the first quarter of 2020. As national lockdowns lift, what is clear is that as people begin to return to their works and livelihoods, there is a new normal to adapt to.

Precisely how this new normal will come to materialise is hard to anticipate. What we can say, however, is that we face nothing if not opportunity.

To mitigate the damaging economic impacts of the COVID-19 pandemic, it is widely understood that financial stimulus will be required the world over. At the very least, industries need to ramp-up activities from dormancy. In both cases, there is a unique opportunity for ensuring that new priorities are set. Opportunity to chart a clear, unequivocal new agenda.

What’s more, strengthened now by recent circumstances which serve to remind that we can indeed act with commonality, with deliberate and swift intent towards great challenges, we can stride forward with a firmer commitment than ever before to tackle our climate crises.

A green recovery

As means of economic stimulus to aid post-pandemic recovery, there is growing momentum for a green recovery – that is to say, to take sustainability and the climate crises as key issues around which to rally and direct investment.

The Institutional Investor Group on Climate Change, which manages more than $34 trillion in assets, captured the spirit of a green recovery well in comments made in a statement released May 4 calling on governments to ensure an economic response that is aligned with the Paris Agreement.

The group asserted: “As governments pursue efforts to recover from this economic downturn, they should not lose sight of the climate crisis…Ultimately, in their recovery plans, governments should prioritise sustainability and equity, and accelerate the transition to a net zero emissions economy to mitigate climate risk, create new jobs and catalyse the sustainable deployment of private capital.”

And the IIGCC’s position echoes that of many other public, investor and industrial groups too – many of which are all calling for a rethink on what the new normal could be and to move forward with sustainability as priority number one.

New priorities with new energy

Multiple sectors require attention within the green recovery, but energy and mobility are certainly key. Investment here will not only kick-start our economy, but tackle some of our greatest challenges and accelerate the transition to a sustainable, resilient society.

As Frans Timmermans, Executive Vice-President for the European Green Deal, commented recently: “If we're going to invest billions in the recovery, let’s not sink it into an obsolete twentieth century fossil fueled economy and soon to be stranded assets, but invest it in a competitive, inclusive and green economy of the twenty-first century for jobs and our health.”

We’re already at an inflection point for these sectors, with change rooted in dual driving forces of electrification and renewable energy. Favorably therefore, we are not calling on investment in unknowns or moon-shots – the studies are in: the technologies are available, viable and ever-more competitive.

What is excellent about investment in these sustainable industries, aside from their direct contribution to addressing the climate crisis, is that time and again, these sectors invariably reveal themselves to give back more than they take.

Consider renewable energy. It’s positioned as a frontrunner to charge economic recovery, with global GDP gains of almost $100 trillion between now and 2050 according to the International Renewable Energy Agency.

For Europe, while decarbonising energy in line with the Paris Agreement would require investing some $4.4 trillion in clean tech, IRENA estimate it would return between $3 and $10 on every dollar invested.

What’s more, beyond economic gains, fostering these sectors means cleaner societies and a cleaner planet. And jobs. Lots of jobs. Globally, investment into clean tech would result in a four-fold growth in the number of jobs in the sector to 42 million over the next 30 years.

Similar patterns of economic returns and new markets for employment are present with the electrification of transportation too, where the benefits go further still if we consider how reductions in emissions promote less pollution, cleaner air, and healthier urban environments.

Julia Poliscanova, Director of Clean Vehicles & Emobility at the European industry group, Transport & Environment, tells Northvolt: “A European battery value chain is critical to the success of eMobility, while also making Europe resilient to global supply chain shocks in the future.”

“The massive public stimulus to relaunch the economy is the opportunity for governments to shape the mobility system and accelerate the transition to zero emissions mobility and electrification. We must not spend money on the polluting engines our cities want to ban and citizens are turning away from. Emobility is the industrial, economic and climate priority for Europe – let's spend the money wisely!”

Electric vehicles will become the standard. Our streets will be cleaner, quieter and safer for them. But we can, and must, seek to make that a reality sooner rather than later – the difference between aggressive and moderate efforts is stark.

We have every reason for confidence in committing investment to the industry, which in Europe can be regarded as having reached a tipping point. The market is the fastest growing in the world, and it is being backed up by a strong industrial manufacturing base. A base composed not only of the automotive sector – in a recent study from McKinsey, it is forecasted that Germany will be the world leading producer of electric vehicles by 2024 – but also battery and related supply chain players.

The contribution of batteries

A common feature to decarbonization of energy and transport is batteries. For Europe, the battery industry represents a vibrant new landscape. An industry not only acting as a linchpin to enable electrification of transportation and advance our use of greater and greater amounts of renewable energy, but also providing economic win in and of itself.

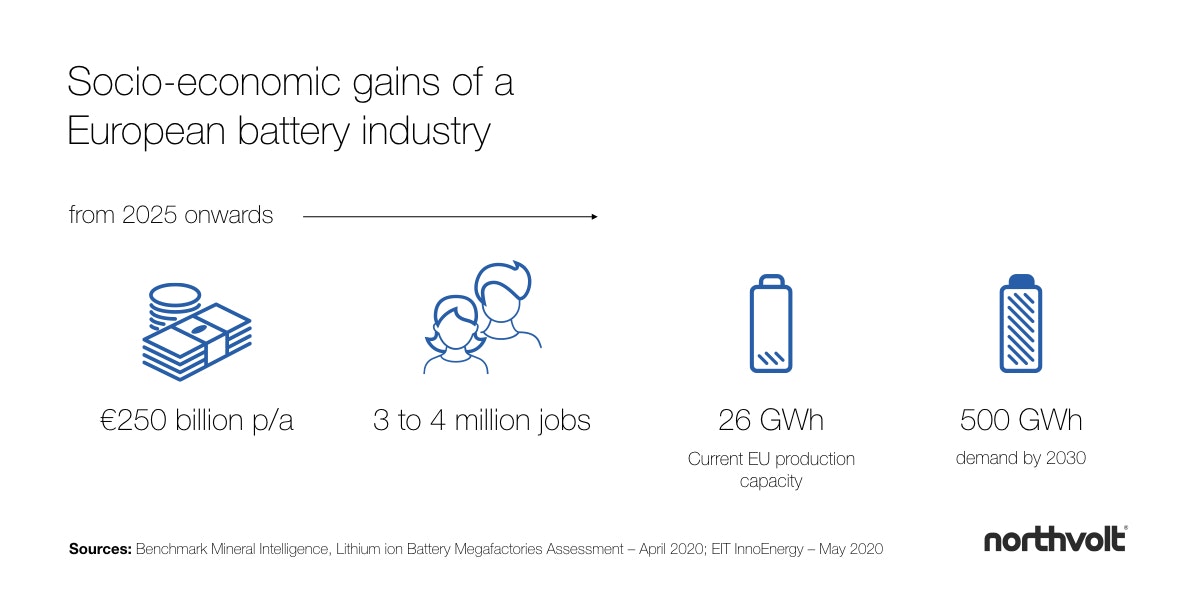

Bo Normark, Industrial Strategy Executive at EIT InnoEnergy, shares an external perspective on long-term socio-economic benefits of the industry, telling Northvolt: “The battery industry has been identified by the Commission as a key industry for Europe. The industry was also specifically mentioned in the launch of the Green Deal. The potential economical impact along the value chain for batteries in Europe is €250 billion per year 2025 onwards, and 3 to 4 million jobs (direct and indirect)”.

Simon Moores, Managing Director of Benchmark Mineral Intelligence, a leading battery supply chain analytics firms, adds perspective on the landscape, telling Northvolt: “The economic growth opportunities are stark: Europe will need at least 500 GWh of capacity within the next 10 years. This is bigger than the world’s entire capacity in 2019 (440 GWh) and if energy storage takes off, this demand number could easily double.”

Moores adds: “These cells will need to come from super-sized battery plants or megafactories, like what Northvolt is pioneering in Sweden and Germany. In a post coronavirus world, this vision is being realised.”

“Not only will this new lithium ion economy create millions of jobs, but it will create a new auto industry and reshape the entire energy landscape for the next 100 years. The economic opportunity in building a lithium ion economy is unprecedented.”

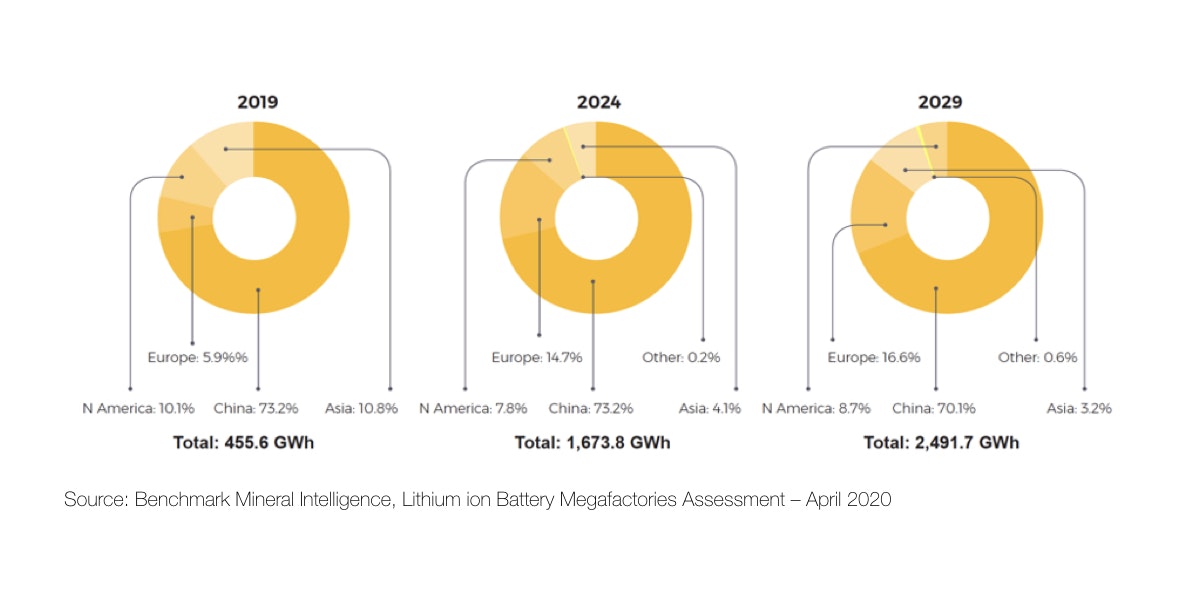

Describing the battery industry as “key to driving the transformation and recovery of European industry,” Normark comments: “We intend for Europe to catch up and eventually lead the global battery industry, and it is on its way by increasing the global market share in lithium-ion batteries from basically zero in 2016 to 5.9% in 2019 and an expected 15.5% by 2025”.

The battery industry is ideally suited within a green recovery, but for success here Normark says the key ingredient is speed of implementation: “It was already important before Corona, even more after Corona.”

All told, the right variables are with us today in Europe to embrace the opportunity we have in our hands to become a champion of sustainability. Fostering the battery, electric automotive, and renewable energy industries are ideal candidates for investment which will pay dividends for the future – we need only reach out, and commit to a green recovery.